Caser Expat Insurance

Health Insurances in Spain for Expats

-

1 month for FREE*

-

Virtual Gym

See in detail all the coverages

When you want to have the best healthcare without giving up any advantages and with total freedom to decide, our most prestigious insurance is your best option. A whole world of possibilities to reduce your worries and give you the most security and cover.

General coverages

Unlimited access, without long waiting lists and the need of referral from your general practitioner. Pediatrics, gynecology, dermatology, endocrinology, traumatology... consult the wide range of medical specialties that we put at your disposal.

Medical Specialities

Allergology

Angiology and Vascular Surgery

Digestive System

Cardiology

General and Digestive System Surgery

Maxillofacial Surgery

Medical-Surgical Dermatology and Venereology

Endocrinology and Nutrition

Geriatrics

Hematology and Hemotherapy

Internal Medicine

Nephrology

Pneumology

Neurosurgery

Clinical Neurophysiology

Neurology

Gynecology

Odontostomatology

Ophthalmology

Medical Oncology

Otorhinolaryngology

Oxygen therapy, ventilation therapy, aerosol therapy

Podiatry

Clinical psychology

Psychiatry

Rehabilitation and physiotherapy

Rheumatology

Pain treatment

Traumatology and Orthopedic Surgery

Urology

Simple and special radiology (digestive, urology and gynecology).

Ultrasound

Discover our Insurance deals

Caser Expat Insurance offers the most advantageous health insurance for expats in Spain. Take a look online and discover our different options.

Médica

Adapta + Dental

- NIE & VISA

Integral

- Family Plan Discount

Salud +60

- NEW

What does it include?

Co-payment

Without co-payments (except psychology 8€)

Primary medicine and pediatrics

Specialties

Diagnostics tools

Hospitalization

2nd medical opinion

Travel assistance

Dental supplement

Assisted reproduction & fertility diagnosis

€100 gift in dental treatments

Best seller for getting a NIE

Reimbursement, up to €600, stem cells cryopreservation

Reimbursement of 50% expenses in optics & pharmacy (up to 100€ per insured/year)

Cardiac rehabilitation

The maximum age limit for taking out a policy is 69

Discover our Insurance deals

Caser Expat Insurance offers the most advantageous health insurance for expats in Spain. Take a look online and discover our different options.

Médica

Adapta + Dental

- NIE & VISA

Integral

- Family Plan Discount

Salud +60

What does it include?

Co-payment

Primary medicine and pediatrics

Specialties

Diagnostics tools

Hospitalization

2nd medical opinion

Travel assistance

Dental supplement

Assisted reproduction & fertility diagnosis

€100 gift in dental treatments

Best seller for getting a NIE

Reimbursement, up to €600, stem cells cryopreservation

Reimbursement of 50% expenses in optics & pharmacy (up to 100€ per insured/year)

Post-heart attack cardiac rehabilitation

The maximum age limit for taking out a policy is 69

Co-payment Caser Activa Health

Here we detail the additional amounts that you must pay when you use the following services. Remember that the first 10 insured copayments per insured per year are free, you will only pay from the 11th on.

Medical assistant services consultation |

€2,50 |

Podiatry and speech therapy |

€4 |

General primary medicine, paediatrics and childcare |

€7,80 |

Rehabilitation treatments and physiotherapy |

€5 |

Specialist consultations |

€15,50 |

Standard diagnostic procedures |

€12 |

Psychology, adults and paediatrics |

€8 |

High-tech and genetic diagnostic procedures |

€40 |

Hospital and home emergencies |

€25 |

At-home services |

€16 |

Postpartum care |

€15 |

Preparation for childbirth |

€38 |

Assisted reproduction |

€45 |

Artificial insemination IVF, ICSI |

€85 |

Other services |

€14 |

Co-payment Caser Integral Health

Here we detail the additional amounts that you must pay when you use the following services. Remember that the first 10 insured copayments per insured per year are free, you will only pay from the 11th on.

Primary care: general medicine, paediatrics and nursing |

€2 |

Speech therapy (session) |

€2 |

Aerosol therapy, ventilation and oxygen therapy |

€2 |

Podiatry |

€2 |

Rehabilitation treatments and physiotherapy (session) |

€2 |

Specialist consultations |

€4 |

Preparation for childbirth |

€4 |

Standard diagnostic tools |

€4 |

Psychology: Adult and paediatric (session) |

€8 |

High-tech diagnostic procedures |

€10 |

Home emergencies |

€10 |

Hospitalization and surgical interventions |

€10 |

Assisted reproduction and artificial insemination |

€10 |

Postpartum care |

€10 |

Other services |

€4 |

Specialities

- Allergology

- Anaesthesiology and resuscitation

- Pathological anatomy

- Angiology and vascular surgery

- Digestive system

- Cardiology

- Anus-rectal surgery. Proctology

- Cardiovascular surgery

- General surgery and digestive system

- Maxillofacial surgery

- Paediatric surgery

- Plastic surgery and reconstructive surgery

- Thoracic surgery

- Dermatology surgical and venereology

- Urology

- Geriatrics

- Haematology and hemotherapy

- Immunology

- Infectious and tropical disease

- Intern medicine

- Nuclear medicine

- Nephrology

- Allergology

- Neonatology

- Pneumology

- Neurosurgery

- Neurophysiology clinic

- Neurology

- Obstetrics and Gynaecology

- Dentistry-stomatology

- Ophthalmology

- Medical oncology

- Radiotherapy oncology

- Otolaryngology

- Psychology Clinic

- Psychiatry

- Rehabilitation and physiotherapy

- Rheumatology

- Pains treatments

- Orthopaedic surgery

Advantages of Caser Health Insurance

Private medical insurance can make your life easier! Here are just a few of our advantages, most of them are included even in our cheap health insurance option.

Avoid long waiting lists

Telephone and on-line medical and pediatric support 24h a day

Diagnostic tests without wait

Diagnostic tests without wait

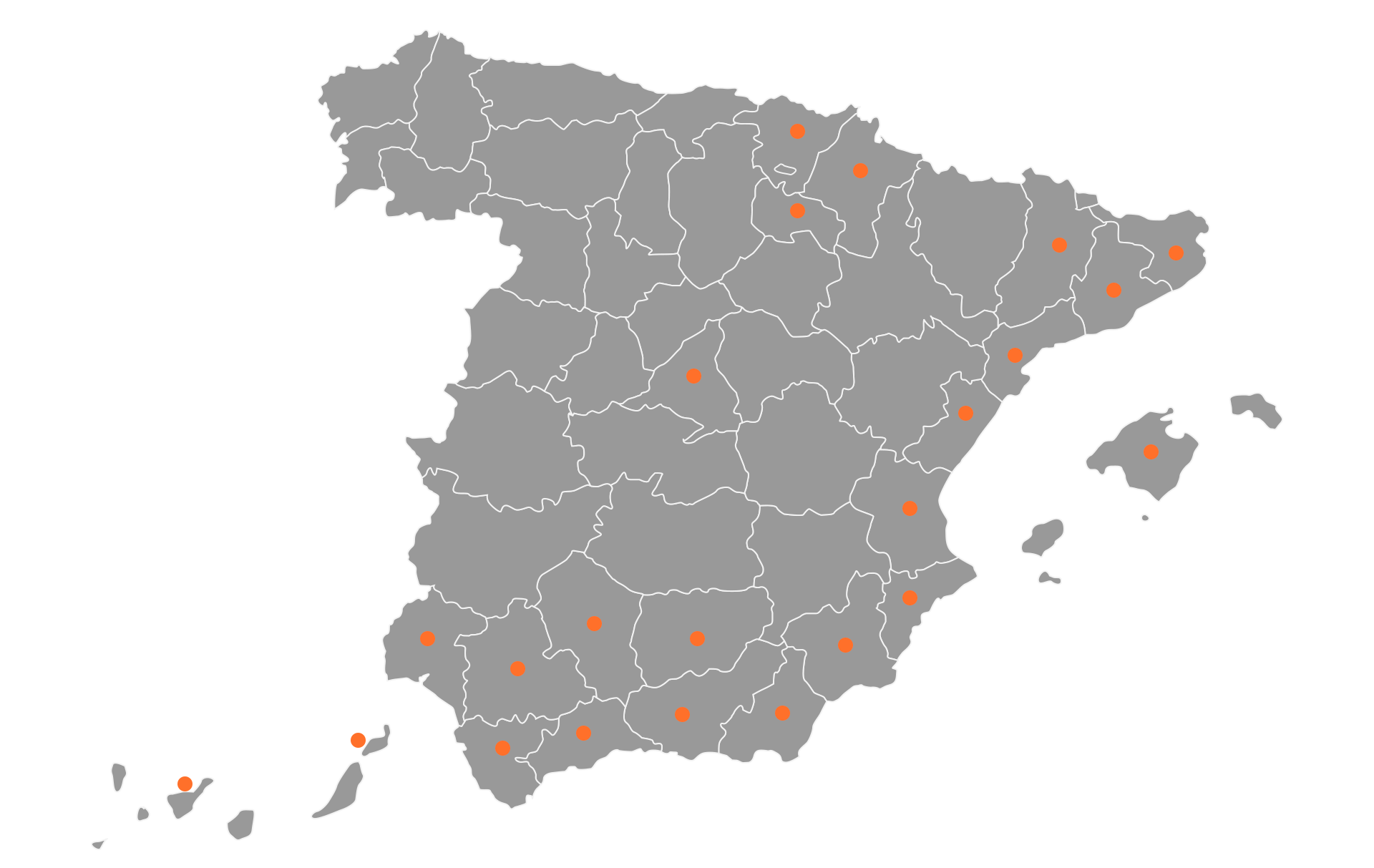

Check out how many health centres are in your region

Caser works with over 13,000 clinics, medical centres and hospitals, and more than 45,000 professionals across Spain.

Madrid

-

1698

País Vasco

-

103

Navarra

-

14

La Rioja

-

38

Lleida

-

239

Girona

-

391

Barcelona

-

2022

Tarragona

-

291

Castellón

-

132

Valencia

-

1015

Alicante

-

453

Mallorca

-

307

Murcia

-

349

Almería

-

203

Jaén

-

222

Granada

-

242

Córdoba

-

379

Málaga

-

540

Sevilla

-

718

Cádiz

-

439

Huelva

-

168

Las Palmas

-

290

Tenerife

-

330

Frequently Asked Questions

If you are still have doubts about how health insurance works and the requirements

for taking out an insurance policy, take a look at our most frequently asked questions.

- Be younger than 69 years old.

- Have a bank account in Spain.

- Have a Spanish address.

- Have a NIE/NIF or passport.

- If you are a minor, the mother, father or legal guardian must be the policyholder.

Medical insurance is an annual policy which renews automatically. If you do not wish to renew your policy, you need to advise us by providing one month’s notice ahead of its expiry date.

In our range of products, there are insurance policies that require co-payment and those without co-payment, to allow the price to be tailored better depending on each person’s use.

The products that offer co-payment involve your co-participation for the use of a service. For the products without co-payment, you only pay the cost of the premium.

Co-payment means that insured persons participate in the cost of the services that are included in the majority of medical insurance policies on the market.

This involves a payment of a small amount by the insured person to make use of certain services, and that way, avoiding an increase in the generic cost of the premium for all customers who hold the same insurance, by assigning these amounts according to the individual use of each person.

Via a personally issued, non-transferable card from Caser. This will show your insurance number, personal details, and the type of insurance that you hold. When you visit a Health Centre, you just need to present the card.

In certain cases, due to safety reasons, you may be asked for another type of identification instead of your card.

Along with the application for medical insurance, a health questionnaire is included. This consists of a health declaration signed by each one of the insured persons who will be included in the policy prior to it being formalised. It includes relevant questions regarding the state of health of each person to be insured. This questionnaire must be completed for each person to be insured (except in the case of minors under the age of 18, whose declaration will be made by their father/mother or legal guardian), where you are obliged to answer each question truthfully, and note down all known circumstances in relation to your health (past and current). These answers will be considered by the insuring entity, in order to make an accurate risk assessment with regard to the insurance policy, reject the policy or establish any exclusions of coverage for any of the pre-existing illnesses that may be declared by the insured persons (prior acceptance of the insured person).

Yes, as long as they are in our extensive directory of renowned medical professionals. You can see on our map many centers there are in your province.

The qualifying periods make reference to the minimum period of time that you have to fulfil following registration as an insured person in the policy, in order to be able to make a claim and use certain services. For example, for procedures, use of high tech diagnostic centres, prosthesis, etc.

Yes, of course. For that to happen, the contract has to have been taken out remotely and the maximum length of time to cancel it is 14 days following receipt of the policy. However, you will be charged for a proportional part of the services that have already been provided.

*Condition of the promotion.